Testing XAI Land’s Villa (연립/다세대) AVM for Seoul with OSB Savings Bank (OSB저축은행) (as of May 21, 2021)

OSB Savings Bank (OSB저축은행) tested XAI Land’s proprietary valuation data generated by the company’s AVM (Automated Valuation Model) against internal mortgage and valuation records to determine how accurate XAI Land’s AVM service is.

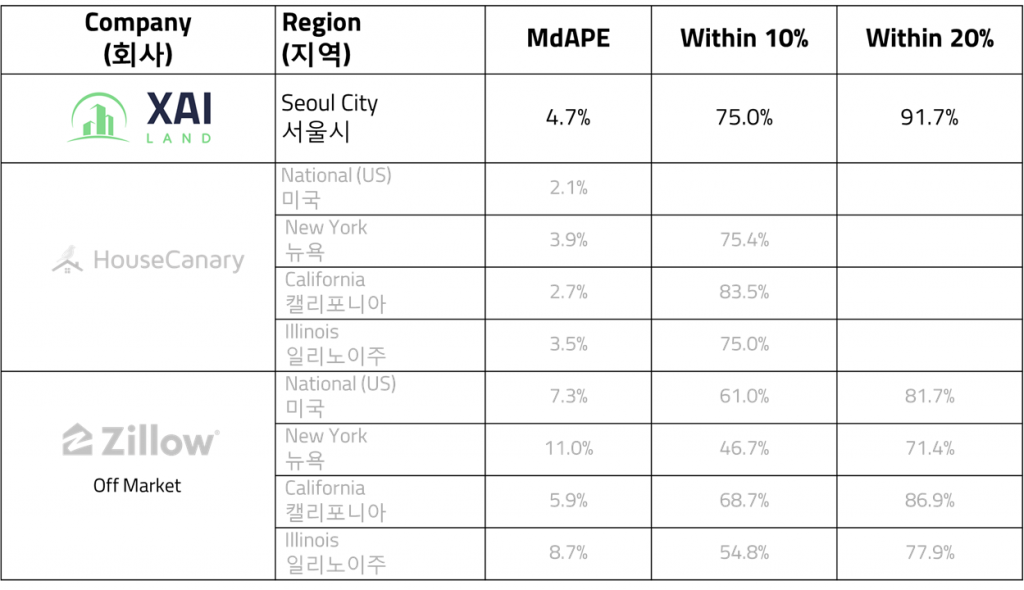

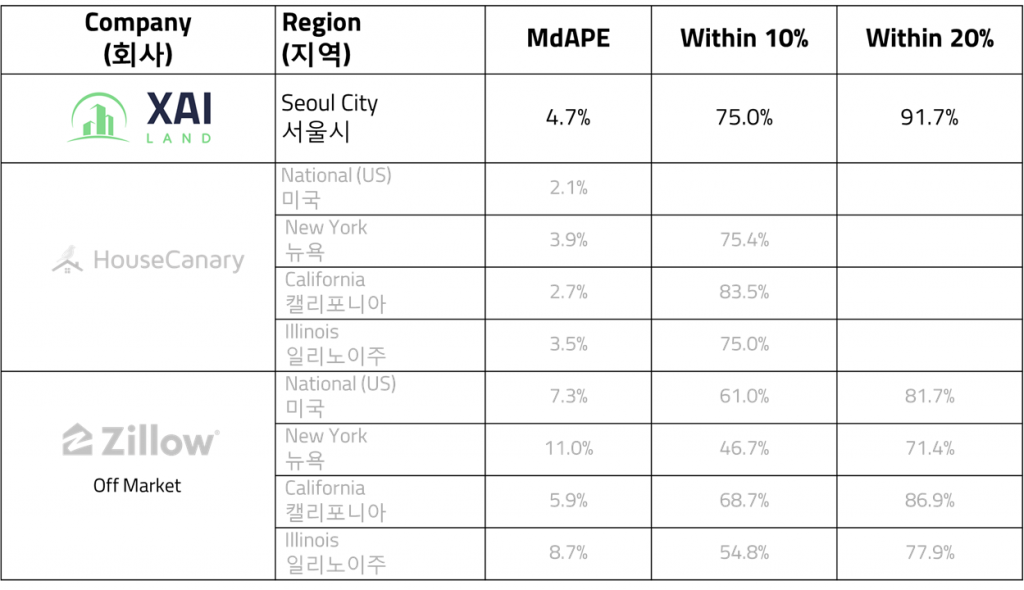

Below, please find the results from OSB Savings Bank’s test of XAI Land’s proprietary valuation database generated from the company’s AVM.

Key summary

- XAI Land’s Median Absolute Percentage Error (MdAPE) was 4.7%.

- This is lower than what Zillow’s reported MdAPE for New York, California, Illinois.

- This is slightly higher than HouseCanary’s reported MdAPE for New York, California, Illinois.

- XAI Land’s valuations fell within +/-10% of what OSB Savings Bank valued properties 75.0% of the time.

- XAI Land’s frequency of providing accurate valuations that fall within +/-10% of real transaction values is more likely than Zillow as Zillow reported their valuations fell within +/-10% of real transaction values between 46.7~68.7% of the time.

- XAI Land’s frequency of providing accurate valuations is similar to HouseCanary as HouseCanary reported their valuations fell within +/-10% of real transaction values between 75.0~83.5% of the time.

- XAI Land’s valuations fell within +/-20% of what OSB Savings Bank valued properties 91.7% of the time.

- XAI Land’s frequency of providing accurate valuations that fall within +/-20% of real transaction values is more likely than Zillow as Zillow reported their valuations fell within +/-20% of real transaction values between 71.4~86.9% of the time.